Gap Coverage

GUARANTEED ASSET PROTECTION

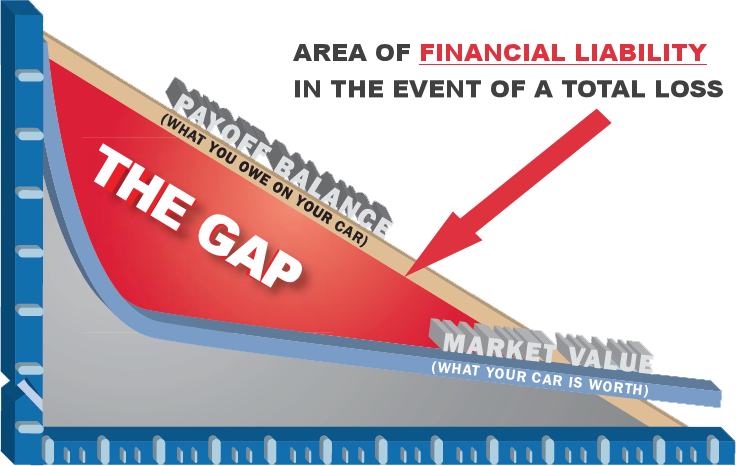

In the event of a total loss of your vehicle, you may well owe more than what your insurance company will pay. The difference in this amount is what is referred to as the “Gap” – However, Ideal Auto Sales provides Gap Coverage to protect you!

WHAT IS GAP COVERAGE?

Gap Coverage waives the difference between what you owe on your vehicle and what your insurance company will pay for your vehicle. In the unfortunate event your vehicle is declared a total loss due to an unrecoverable theft or accidental damage, your auto insurance company will typically pay the current market value of your vehicle less your deductible. But what if your loan or lease balance is higher than the market value of your vehicle?

Answer: You would be responsible for paying off the difference, including your deductible. This can be expensive. The reason for the potential difference is that normally the loan/lease balance decreases at a predictable amount as monthly payments are made. However, the market value of your vehicle is influenced by several variable factors (e.g. supply, demand, mileage). This means that market value often may be lower than your outstanding balance – particularly early in your contract when you have the most to lose.

ARE YOU PREPARED TO PAY THE DIFFERENCE?

Is the amount you receive from your insurance company enough to pay-off your loan or lease balance if your vehicle is declared a total loss? For Example…

Insurance Settlement:

– Market Value of Vehicle: $13,000

– Less Insurance Deductible: –$1,000

– Total Insurance Proceeds: $12,000

Amount owed on vehicle: $18,500

Difference in Amounts: ($6,500)

In this example, the answer is No! The difference illustrates what you would still owe your lender without

GAP Coverage from Ideal Auto Sales. You would be responsible for still paying over six thousand dollars. Protect yourself by contacting us today for GAP coverage!